**The year 2025 has dawned with a chilling trend reverberating across various sectors, and the Republic National Distributing Company (RNDC) finds itself at the epicenter of this economic tremor. As news of the RNDC layoffs 2025 spreads, it paints a stark picture of a company grappling with significant internal and external pressures, leading to a substantial reduction in its workforce.** This article delves into the specifics of these job cuts, exploring the underlying causes, the broader industry context, and the potential ramifications for one of the largest wine and spirits distributors in the United States. The ongoing wave of layoffs at RNDC is not an isolated incident but rather a symptom of a complex interplay of market shifts, competitive pressures, and internal operational challenges. From the specific dates of announcements to the roles most affected, and the wider economic currents influencing the alcohol distribution landscape, we aim to provide a comprehensive and insightful look into the situation, offering clarity amidst the uncertainty for employees, industry stakeholders, and the general public.

Table of Contents

- The Broader Landscape of 2025 Layoffs

- RNDC's Unfolding Crisis: A Timeline of Reductions

- Why RNDC? Unraveling the Core Issues

- The Alcohol Industry's Shifting Sands

- Internal Turmoil: Employee Perspectives and Operational Strain

- The Ripple Effect: What These Layoffs Mean for the Industry

- Navigating Uncertainty: Advice for Those Affected

- Looking Ahead: The Future of RNDC and the Distribution Landscape

The Broader Landscape of 2025 Layoffs

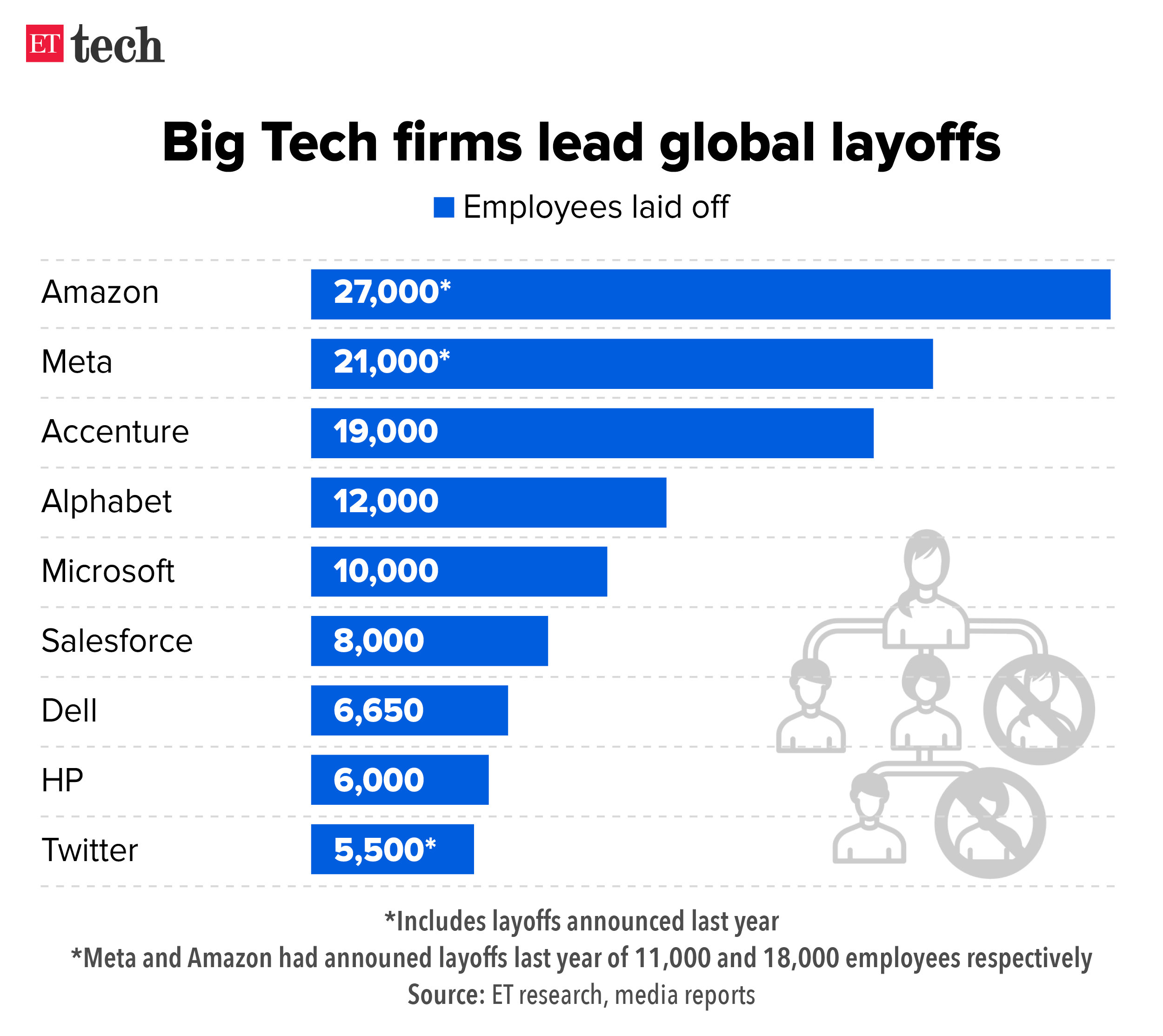

The RNDC layoffs 2025 are occurring within a challenging economic environment, where job cuts have become a pervasive theme across various industries. As of January 1st, 2025, a staggering 1247+ companies have announced mass layoffs, indicating a widespread trend of corporate restructuring and cost-cutting measures. This isn't just a ripple; it's a significant wave impacting the global workforce. Major corporations, from tech giants like Amazon to aerospace manufacturers such as Boeing and even budget carriers like Spirit Airlines, have all made announcements that will see employees impacted well into 2025. This broader context is crucial for understanding the situation at Republic National Distributing Company. While the specifics of RNDC's challenges are unique to the alcohol distribution sector, the general economic climate, characterized by inflationary pressures, shifting consumer behaviors, and a cautious outlook from businesses, creates a backdrop where such drastic measures become more common. The map of layoffs for 2025 shows a concerning pattern across all states, with layoffs over time indicating a sustained period of workforce reductions. Intel, for instance, is also preparing to lay off factory workers in Oregon, further illustrating the diverse nature of industries affected. This widespread trend suggests that companies are bracing for potential economic headwinds, making efficiency and cost control paramount.RNDC's Unfolding Crisis: A Timeline of Reductions

The Republic National Distributing Company, LLC (RNDC) has been a significant player in the alcohol distribution industry for decades. However, 2025 marks a particularly turbulent period for the company, with multiple rounds of job cuts signaling deep-seated issues. The history of RNDC layoffs isn't entirely new; Republic National Distributing Company, LLC filed three WARN layoff notices between May 2011 and March 2025 in Arizona and California, resulting in a total of 370 employees being laid off from those previous announcements. However, the scale and speed of the current RNDC layoffs 2025 appear to be unprecedented in recent memory.The January 7th Announcement

A pivotal moment in the current wave of RNDC layoffs 2025 was the announcement made on January 7th, 2025. While the exact total number of employees impacted on this specific date hasn't been widely publicized in a single, definitive figure, reports from former employees and insiders on social media quickly confirmed the severity of the cuts. This initial announcement set the stage for what would become a series of ongoing reductions, indicating a strategic, albeit painful, pivot for the company. The rapid spread of information through channels like the *unofficial* Republic National Distributing Co. community, with its 1.2k subscribers, highlights the immediate and personal impact these decisions had on the workforce.Beyond the Initial Cuts: Specific Roles Affected

The impact of the RNDC layoffs 2025 has been far-reaching, affecting various departments and roles within the company. Reports indicate that over 100 associates were cut on a single day, including critical positions such as sales representatives and merchandisers. These roles are often the direct link between the distributor and its clients, making their reduction particularly impactful on day-to-day operations and client relationships. Furthermore, assistant district managers were also affected, though not completely eliminated, suggesting a restructuring rather than a complete dismantling of certain functions. In addition to these broader categories, specific teams also faced significant reductions. For instance, three representatives from the Estates Group were eliminated. While it remains unclear if this specific number was part of the larger 100+ associates cut or a separate, more targeted reduction, it underscores the granular level at which these layoffs are being implemented. The consistent flow of information from insiders confirms that the workforce reductions are not isolated incidents but a systemic overhaul, indicating that the company is undergoing a profound transformation that prioritizes leaner operations, even at the cost of experienced personnel.Why RNDC? Unraveling the Core Issues

The significant RNDC layoffs 2025 are not arbitrary; they stem from a confluence of internal operational challenges and external market pressures that have put immense strain on the company's financial health and competitive standing. Understanding these core issues is key to comprehending the necessity and scale of the recent job cuts.Hemorrhaging Supplier Accounts: A Critical Blow

One of the most critical factors contributing to RNDC's current predicament is the substantial loss of key supplier accounts. Not even halfway into 2025, Republic National Distributing Company (RNDC) has reportedly "hemorrhaged key supplier accounts in markets across the country, and especially in California." The loss of these accounts means a direct reduction in the volume of products RNDC distributes, leading to a corresponding decrease in revenue. In the highly competitive alcohol distribution industry, maintaining strong relationships with suppliers is paramount. When major brands or producers choose to move their business elsewhere, it creates a significant void that is difficult to fill quickly. This loss of business directly impacts the need for a large sales and distribution workforce, making layoffs an almost inevitable consequence. The California market, being one of the largest and most influential in the U.S. alcohol industry, represents a particularly painful blow for RNDC.Legal Battles and Competitive Pressures

Beyond the loss of supplier accounts, RNDC, along with its fellow large distributor Southern Glazers Wine & Spirits (SGWS), faces significant legal challenges that are draining resources and potentially impacting their market position. In May, a federal judge rejected SGWS's motion to dismiss a lawsuit brought by Provi, an online alcohol seller. This lawsuit alleges that Southern Glazers and RNDC "stifle competition in the alcohol industry." Such anti-competition lawsuits are costly, regardless of the outcome. Unless there's a settlement, Southern Glazers, and by extension, potentially RNDC, are "looking at millions of dollars in legal fees, regardless of who wins." These legal battles not only incur substantial financial costs but also cast a shadow over the companies' business practices, potentially deterring new suppliers or exacerbating existing tensions with smaller competitors. The pressure to maintain market dominance while navigating complex legal landscapes adds another layer of complexity to RNDC's operational challenges, contributing to the need for cost-cutting measures, including the RNDC layoffs 2025. The intense competition within the distribution sector, coupled with allegations of anti-competitive behavior, creates a high-stakes environment where efficiency and financial prudence become paramount.The Alcohol Industry's Shifting Sands

The RNDC layoffs 2025 are not just a reflection of company-specific issues but also indicative of broader shifts and challenges within the alcohol distribution industry itself. This sector, often perceived as stable, is undergoing significant transformations that impact profitability and operational models.Is Wine Recession-Proof? A Closer Look

There's a common misconception that certain luxury goods, like wine, are recession-proof. However, this notion is increasingly being challenged. As one observer noted, "I don’t work for RNDC but I would challenge the notion that wine is recession proof." In an economic downturn, consumer behavior shifts dramatically. "The first thing that stops in an economic downturn is people eating out which obviously hurts on-prem" sales (sales in restaurants, bars, etc.). This direct hit to on-premise consumption, a significant channel for wine and spirits, immediately impacts distributors like RNDC. Beyond on-premise sales, wine, especially higher-end varieties, is considered a luxury good. Its value "has dropped pretty significantly on the auction" market during economic slowdowns, indicating a broader decline in demand for non-essential items. When consumers tighten their belts, discretionary spending on alcohol, particularly premium products, is often among the first to be reduced. This economic reality directly affects the volume of sales for distributors, necessitating adjustments in workforce size to match reduced demand and revenue.The Impact of Wholesale Consolidation

The alcohol distribution landscape has undergone massive consolidation over the past two decades. There was a time, "maybe 20 years ago before the massive wholesale consolidation took place, when wholesalers actually marketed and promoted the brands and wines they represented." This era of localized, relationship-driven distribution has largely given way to a few dominant players, including RNDC and Southern Glazers. While consolidation can bring efficiencies of scale, it also creates an environment where smaller brands struggle to gain attention, and the focus shifts from bespoke marketing to sheer volume and logistical prowess. This consolidation has led to a more centralized, and arguably less agile, distribution model. It has also intensified competition among the few remaining giants, making the loss of key supplier accounts even more devastating. The shift from a marketing-centric role to a logistics-and-volume-centric one may also require a different kind of workforce, potentially rendering some traditional roles redundant and contributing to the need for the RNDC layoffs 2025. The union's concern about 1600 Scottish jobs being at risk if the government doesn't act in the 'national interest' further highlights the vulnerability of employment in consolidated industries when economic or policy shifts occur.Internal Turmoil: Employee Perspectives and Operational Strain

Beyond the external market pressures and legal challenges, insider accounts suggest that RNDC is also grappling with significant internal turmoil, which is exacerbated by the RNDC layoffs 2025. The rapid pace and scale of the job cuts have reportedly created a challenging environment for those who remain. According to some employees, "RNDC is currently destroying itself." The sentiment is that "They've fired far too many people too quickly and it is physically impossible for those of us who remain to complete their tasks to keep the company running." This indicates a severe issue with understaffing and an unsustainable workload for the remaining employees. When a significant percentage of the workforce is cut, the tasks previously handled by those individuals don't simply disappear. They fall onto the shoulders of the remaining staff, leading to burnout, decreased morale, and a potential decline in service quality. Compounding these issues, the company is reportedly "also implementing new tech with no support for the transitions, which compounds the issues with losing a huge % of our workforce." Introducing new technology without adequate training, support, or a sufficient workforce to manage the transition can lead to significant operational bottlenecks, errors, and frustration. This combination of drastic workforce reductions and poorly managed technological transitions creates a vicious cycle where efficiency declines, errors increase, and the overall ability of the company to function effectively is compromised. This internal strain not only impacts employee well-being but also directly affects the company's ability to serve its remaining suppliers and customers, potentially accelerating the very decline it seeks to avoid.The Ripple Effect: What These Layoffs Mean for the Industry

The RNDC layoffs 2025 send a strong signal across the entire alcohol distribution industry. As one of the largest players, RNDC's struggles are not isolated; they reflect broader challenges and could trigger a ripple effect. For suppliers, these layoffs might mean disruptions in distribution channels, changes in sales strategies, and potentially the need to seek alternative partners. Smaller brands, in particular, might find it even harder to gain traction if major distributors are consolidating their focus on top-tier brands or struggling with internal capacity. For competitors, RNDC's challenges could present opportunities to gain market share, but also serve as a cautionary tale. The issues faced by RNDC – loss of accounts, legal battles, and internal operational strain – are not unique to one company and could affect others in a highly competitive and consolidating market. The overall health of the distribution sector is crucial for the entire alcohol supply chain, from producers to retailers. A weakened distribution link can lead to inefficiencies, increased costs, and reduced market access for various products. The current situation underscores the need for resilience and adaptability within the industry as it navigates economic shifts and evolving consumer demands.Navigating Uncertainty: Advice for Those Affected

For the individuals directly impacted by the RNDC layoffs 2025, the immediate future is undoubtedly filled with uncertainty. Losing a job is a challenging experience, both financially and emotionally. For those who have been laid off, it's crucial to immediately assess personal finances, understand severance packages (if any), and explore unemployment benefits. Networking within the industry, updating resumes, and leveraging platforms like LinkedIn or industry-specific job boards (such as winejobs.com, which provides compensation reports for winery jobs) can be vital steps. For those who remain at RNDC, the situation also presents its own set of challenges. Increased workloads, potential burnout, and a climate of uncertainty can take a toll. It's important for remaining employees to communicate concerns to management, advocate for adequate resources, and prioritize their well-being. Understanding the company's strategic direction and how their roles fit into the new, leaner structure can also help in navigating this period of transition. The unofficial RNDC community and other online forums can also serve as platforms for sharing information and support, though caution should always be exercised regarding sensitive company information.Looking Ahead: The Future of RNDC and the Distribution Landscape

The RNDC layoffs 2025 mark a significant turning point for the company. While painful, these drastic measures are likely an attempt to right-size the organization, reduce costs, and adapt to a changing market. The future of RNDC will depend heavily on its ability to stem the loss of supplier accounts, resolve its legal challenges, and successfully implement its new operational strategies and technologies without completely alienating its remaining workforce. The internal reports of the company "destroying itself" due to rapid cuts and poor tech support highlight the critical need for a more measured and supportive approach to change management. The broader alcohol distribution landscape will continue to evolve. The trend of consolidation, the increasing pressure from online alcohol sellers like Provi, and the fluctuating nature of consumer spending will keep the industry on its toes. Distributors will need to demonstrate exceptional agility, technological prowess, and strong supplier relationships to thrive. The RNDC situation serves as a stark reminder that even established giants are not immune to market forces and the necessity of continuous adaptation. The industry's ability to innovate, embrace new business models, and address anti-competition concerns will define its trajectory in the years to come.Conclusion

The RNDC layoffs 2025 are a complex and multi-faceted issue, deeply rooted in both company-specific challenges and broader industry trends. From the significant loss of key supplier accounts and ongoing legal battles to the general economic downturn impacting consumer spending on luxury goods like wine, RNDC finds itself at a critical juncture. The internal strain on remaining employees, coupled with poorly supported technological transitions, further compounds the company's operational difficulties. This situation serves as a powerful illustration of the volatile nature of even established industries in the face of rapid change and economic pressures. For those impacted, seeking support and proactively planning the next steps is crucial. For the industry at large, RNDC's struggles are a wake-up call, emphasizing the need for adaptability, innovation, and a keen understanding of market dynamics. The path forward for RNDC and the alcohol distribution sector will undoubtedly require strategic pivots, a focus on efficiency, and a renewed commitment to fostering strong relationships across the supply chain. What are your thoughts on the RNDC layoffs 2025? Have you or someone you know been affected by these changes? Share your insights and experiences in the comments below. If you found this article informative, please consider sharing it with your network or exploring other related articles on our site to stay informed about industry trends.