In the dynamic world of financial markets, where every second counts and information is king, the promise of artificial intelligence (AI) has captured the imagination of traders worldwide. Enter Gomoon.ai, a platform positioning itself at the forefront of this revolution. It claims to be an AI-powered economic calendar designed to give traders an edge, helping them navigate the complexities of global economic events with unprecedented clarity. But does this innovative tool deliver on its ambitious claims, or is it merely sophisticated marketing dressed up in the latest tech buzzwords?

This comprehensive article will delve deep into Gomoon.ai, exploring its core functionalities, the benefits it purports to offer, and the challenges inherent in relying on AI for critical financial decisions. We'll examine how it aims to transform the way retail traders approach the market in 2025, from forecasting stock market activity to hedging against economic events. By the end, you'll have a clearer understanding of whether Gomoon.ai truly represents the smart way to trade in an increasingly data-driven landscape.

Table of Contents

- Gomoon.ai: An Introduction to AI-Powered Trading

- The Core Mechanics: Decoding Economic Events with AI

- Benefits of AI Trading in 2025: A Gomoon Perspective

- Who Is Gomoon.ai For? Understanding the Target Audience

- Trust and Transparency: Terms and Conditions

- Challenges and Considerations in AI Trading

- Gomoon.ai in the Broader Landscape: Top AI Trading Tools for 2025

- Getting Started with Gomoon.ai

- Conclusion: Is Gomoon.ai Your Next Trading Ally?

Gomoon.ai: An Introduction to AI-Powered Trading

In a world increasingly shaped by data, the financial markets stand as one of the most complex and data-rich environments imaginable. Traders constantly seek an edge, a way to process vast amounts of information quickly and accurately to make profitable decisions. This is where artificial intelligence steps in, promising to cut through the noise and deliver actionable insights. Gomoon.ai positions itself as a key player in this evolving landscape, specifically targeting the intricate relationship between economic events and market movements. It's not just another trading platform; it's an AI-powered economic calendar for traders that allows you to track and analyze event impacts on various markets effortlessly. This distinction is crucial: instead of directly executing trades, Gomoon.ai focuses on providing the intelligence needed to make smarter, more informed trading decisions, acting as a sophisticated analytical co-pilot for market participants.

The core proposition of Gomoon.ai revolves around its ability to use AI to decode economic events for smarter trading. This involves more than just listing upcoming announcements; it's about understanding the potential ripple effects, the market's historical reactions, and how current sentiment might amplify or dampen those impacts. The platform aims to transform how traders think about upcoming financial events, moving beyond simple anticipation to a deeper, data-driven understanding of potential market shifts. With over 6,000+ traders reportedly trusting its insights, Gomoon.ai certainly has a compelling story to tell, suggesting a growing community of users who find value in its unique approach to market intelligence.

The Core Mechanics: Decoding Economic Events with AI

At the heart of Gomoon.ai's offering lies its sophisticated use of artificial intelligence to interpret and contextualize economic data. Traditional economic calendars merely list events like GDP reports, inflation figures, or central bank announcements. While useful, they lack the analytical depth required to truly understand the potential market ramifications. Gomoon.ai aims to bridge this gap by employing AI algorithms that go beyond simple data aggregation, delving into the nuances of how these events might influence various asset classes. This is where the platform truly distinguishes itself, moving from a passive information source to an active analytical engine that provides a more intelligent perspective on market-moving news.

How Gomoon Assesses Economic Events for Trading

The process by which Gomoon uses AI to assess economic events for trading is multifaceted. It likely involves ingesting vast quantities of historical economic data, news articles, market sentiment indicators, and trading volumes. The AI then learns patterns and correlations that might not be immediately obvious to the human eye. For instance, it can identify how specific types of interest rate announcements have historically impacted currency pairs, bond yields, or stock indices under different market conditions. Furthermore, the platform encourages users to look for discrepancies between forecasts and actual outcomes to gauge market sentiment. This is a critical feature, as markets often react not just to the news itself, but to how the news deviates from expectations. Gomoon.ai’s AI can highlight these discrepancies, providing traders with a clearer picture of whether a market reaction is driven by surprise, confirmation, or a more complex interplay of factors. This analytical depth allows traders to anticipate potential volatility and position themselves accordingly, rather than simply reacting to headlines.

Tracking and Analyzing Event Impacts Effortlessly

Beyond assessing individual events, Gomoon.ai is designed to allow traders to track and analyze event impacts on various markets effortlessly. This means providing a holistic view of how a single economic release might affect multiple asset classes simultaneously. For example, a strong jobs report in the US could strengthen the dollar, potentially weaken gold, and boost stock market confidence. The AI helps to connect these dots, presenting a cohesive narrative of potential market shifts. This effortless tracking and analysis are crucial for busy traders who don't have the time to manually cross-reference data points across different platforms. By consolidating this information and providing AI-driven insights, Gomoon.ai aims to save traders valuable time and reduce cognitive load, allowing them to focus on strategy and execution rather than laborious data compilation. It transforms the economic calendar from a static list into an interactive, intelligent dashboard.

Benefits of AI Trading in 2025: A Gomoon Perspective

The allure of AI in trading is undeniable, promising to enhance decision-making, reduce emotional biases, and potentially unlock new opportunities. Gomoon.ai leverages these promises, focusing on specific advantages that can empower traders in the complex market environment of 2025. The platform's design is geared towards providing actionable intelligence that translates directly into more informed and potentially more profitable trading strategies. It moves beyond theoretical AI applications to deliver practical tools that address real-world trading challenges, particularly those stemming from unpredictable economic shifts.

Forecasting Stock Market Activity and Avoiding Costly Surprises

One of the most significant benefits Gomoon.ai offers is its potential to help traders forecast stock market activity and avoid costly surprises. Traditional market analysis often relies on lagging indicators or human interpretation, which can be slow and prone to error. AI, however, can process vast datasets in real-time, identifying subtle patterns and correlations that might precede major market moves. By decoding economic events and their historical impacts, Gomoon.ai provides a forward-looking perspective. For instance, if the AI identifies a strong historical correlation between a particular inflation report and subsequent sector-specific stock movements, it can flag this potential outcome for traders. This proactive insight allows traders to adjust their portfolios, enter or exit positions, or even prepare for increased volatility before the market fully reacts. This capability is invaluable in minimizing unexpected losses and capitalizing on anticipated trends, providing a crucial layer of protection against sudden market shocks.

The Smart Way to Hedge Against Economic Events

Beyond forecasting, Gomoon.ai also positions itself as the smart way to hedge against economic events in 2025. Hedging is a risk management strategy used to offset potential losses from adverse price movements. In the context of economic events, this means protecting existing positions from the fallout of unexpected news. Gomoon.ai’s economic calendar transforms how traders think about upcoming financial events by providing predictive insights into their potential impact. For example, if the AI suggests a high probability of a certain economic announcement causing a significant downturn in a particular currency, a trader holding positions in that currency might use this information to open an offsetting position in a related asset, such as a currency option or a futures contract. This proactive hedging, informed by AI-driven analysis, can significantly mitigate risk. By understanding the potential ripple effects of economic news across various markets, traders can implement more precise and effective hedging strategies, safeguarding their capital against unforeseen volatility and protecting their existing investments from adverse economic shifts.

Who Is Gomoon.ai For? Understanding the Target Audience

While the promise of AI in trading might sound universally appealing, Gomoon.ai specifically targets a particular segment of the trading community. It's not designed for high-frequency traders who rely on millisecond advantages, nor is it exclusively for institutional investors with massive proprietary systems. Instead, Gomoon.ai is tailored for retail traders who want a balance of automation and education, especially those looking to buy/rent AI strategies without coding. This focus on accessibility and practical application for individual investors is a key differentiator, making advanced AI insights available to a broader audience who might not have the technical expertise to build their own algorithms.

The platform caters to those who understand the value of data-driven decisions but may lack the time, resources, or programming skills to develop complex analytical models themselves. For these retail traders, Gomoon.ai offers a streamlined solution: an AI-powered economic calendar that simplifies the process of understanding market-moving events. It provides the analytical horsepower without requiring users to delve into the intricacies of machine learning algorithms. This means traders can leverage sophisticated AI insights to gauge market sentiment and identify potential trading opportunities without needing to write a single line of code. It empowers a new generation of traders to engage with the market more intelligently, bridging the gap between traditional manual analysis and fully automated algorithmic trading, offering a hybrid approach that combines human oversight with AI-driven intelligence.

Trust and Transparency: Terms and Conditions

In the financial technology sector, especially when dealing with tools that influence investment decisions, trust and transparency are paramount. Gomoon.ai, like any reputable online service, operates under a clear set of guidelines and legal frameworks designed to protect both the user and the platform. These terms and conditions outline the rules and regulations for the use of our website and services. It's not merely legal jargon; it's a fundamental aspect of establishing a trustworthy relationship with its user base, particularly given the YMYL (Your Money Your Life) nature of financial tools. Understanding these terms is crucial before engaging with any financial service, and Gomoon.ai makes it clear that user acceptance is a prerequisite for access.

By accessing this website, we assume you accept these terms and conditions in full. This statement emphasizes the importance of due diligence on the part of the user. It means that by simply navigating the site and utilizing its features, you are implicitly agreeing to abide by the established rules. Furthermore, the platform explicitly states: Do not continue to use gomoon.ai if you do not accept all of the terms and conditions stated on this page. This clear directive underscores the non-negotiable nature of the terms, ensuring that users are fully aware of their obligations and the platform's limitations. For a service that is trusted by 6,000+ traders, this level of transparency is vital. It builds credibility and assures users that the platform operates within a defined legal and ethical framework, which is essential for fostering confidence in an AI-powered tool that influences financial decisions. Users should always review these documents carefully to understand data privacy, service limitations, and dispute resolution processes.

Challenges and Considerations in AI Trading

While the benefits of AI in trading, as exemplified by Gomoon.ai, are compelling, it's crucial to approach these tools with a balanced perspective. The financial markets are inherently complex and unpredictable, and even the most advanced AI is not infallible. Understanding the limitations and challenges associated with AI trading is just as important as recognizing its advantages. This critical assessment aligns with the E-E-A-T principles, ensuring that users receive a comprehensive and realistic view of what to expect.

One primary challenge lies in the "black box" nature of some AI algorithms. While Gomoon.ai focuses on providing insights from an economic calendar, the underlying mechanisms by which the AI decodes economic events can be opaque. Traders might see the output – a potential impact assessment or a discrepancy highlight – but fully understanding *why* the AI reached that conclusion can be difficult. This lack of complete transparency can be a concern, especially when significant capital is at stake. Furthermore, AI models are trained on historical data. While this allows them to identify patterns, they can struggle with unprecedented events or "black swan" occurrences that fall outside their training parameters. The COVID-19 pandemic, for example, presented unique market dynamics that even sophisticated AI models might not have accurately predicted based solely on past economic cycles. Therefore, human oversight and critical thinking remain indispensable, even when leveraging powerful AI tools. Traders must remember that AI is a tool to augment, not replace, their own judgment and risk management strategies. It's about enhancing decision-making, not guaranteeing outcomes.

Gomoon.ai in the Broader Landscape: Top AI Trading Tools for 2025

The landscape of AI trading tools is rapidly expanding, with new platforms and functionalities emerging constantly. In 2025, the market is expected to be even more saturated with sophisticated solutions catering to various trading styles and needs. Gomoon.ai positions itself within this competitive environment, offering a distinct value proposition centered on economic event analysis. While it doesn't aim to be an all-encompassing trading bot, its specialized focus makes it a notable contender among the top AI trading tools for 2025.

When considering the "Top 7 AI trading tools for 2025," Gomoon.ai's strength lies in its niche: providing an AI-powered economic calendar for traders that allows you to track and analyze event impacts on various markets effortlessly. Many other AI tools might focus on algorithmic execution, technical analysis pattern recognition, or sentiment analysis from social media. Gomoon.ai, however, zeroes in on the fundamental drivers of market movement – economic events – and applies AI to extract deeper insights from them. This specialization makes it a valuable complementary tool for traders who already employ other strategies but need a more intelligent way to understand and react to macroeconomic news. Its ability to help forecast stock market activity and avoid costly surprises by decoding economic events for smarter trading sets it apart, offering a unique layer of market intelligence that can be integrated into a broader trading strategy. For those seeking to hedge against economic events in 2025 with greater precision, Gomoon.ai offers a compelling solution that complements the functionalities of other AI-driven platforms.

Getting Started with Gomoon.ai

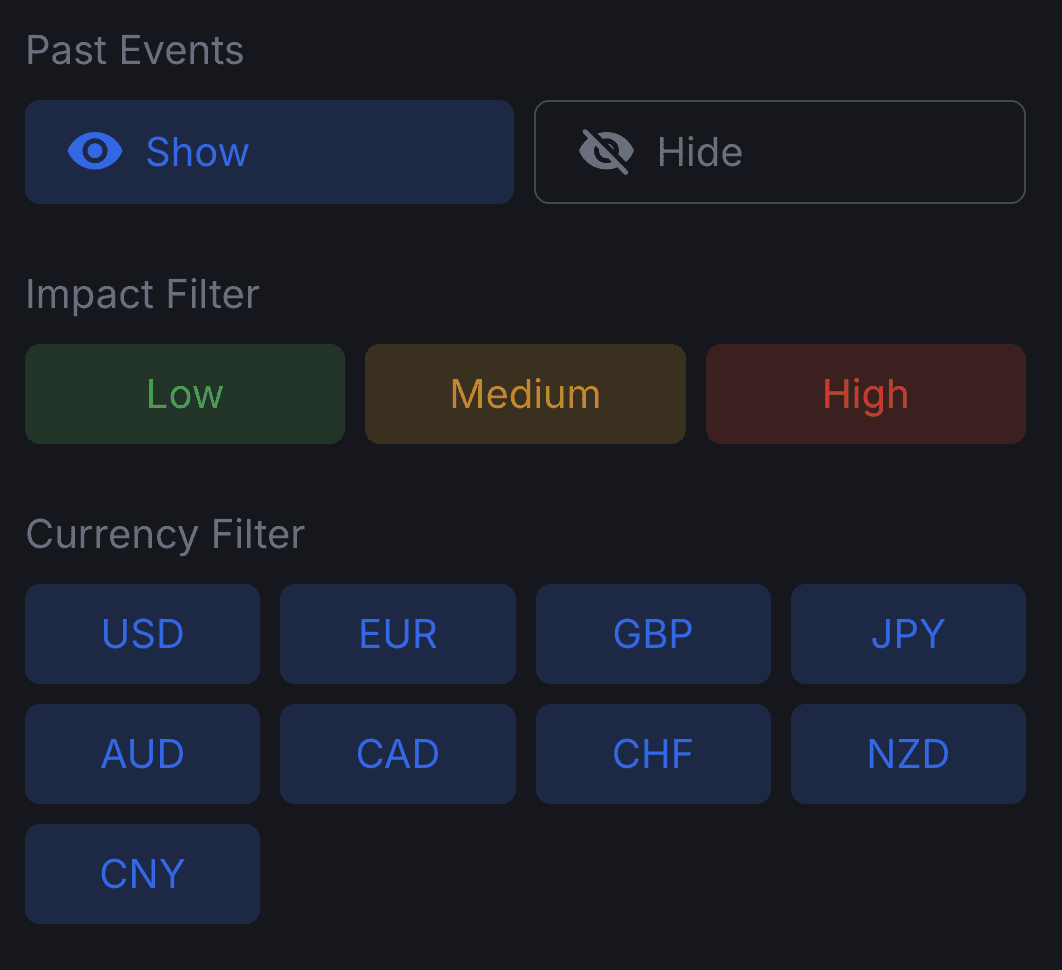

For retail traders intrigued by the potential of AI-powered economic analysis and ready to explore how Gomoon.ai can enhance their trading strategy, the process of getting started is designed to be straightforward and user-friendly. The platform emphasizes accessibility, aligning with its target audience of traders who prefer a balance of automation and education without needing to delve into complex coding or setup procedures. The initial step is simple and familiar to anyone who has joined an online service: create a new account with gomoon.ai. This entry point is designed to be seamless, allowing potential users to quickly access the platform and begin exploring its features.

Once an account is created, users can begin to leverage the core functionalities of Gomoon.ai. This typically involves familiarizing oneself with the interface, understanding how the AI-powered economic calendar presents information, and exploring the analytical tools available. The platform's emphasis on tracking and analyzing event impacts on various markets effortlessly means that users should find the navigation intuitive. For those looking to buy/rent AI strategies without coding, the platform likely offers clear pathways to integrate these insights into their trading decisions. Given that Gomoon.ai is trusted by 6,000+ traders, there's an implicit promise of a robust and reliable system, backed by a community of users who have found value in its offerings. As with any financial tool, it's advisable to start by exploring the features, perhaps with a demo or trial period if available, to fully understand how Gomoon.ai can best serve your individual trading needs before committing significant resources or relying solely on its insights for live trading decisions.

Conclusion: Is Gomoon.ai Your Next Trading Ally?

In the rapidly evolving landscape of financial technology, Gomoon.ai presents itself as a compelling solution for traders seeking an edge in navigating the complexities of economic events. Its core proposition—an AI-powered economic calendar designed to decode economic events for smarter trading—addresses a critical need for timely, insightful, and actionable information. For retail traders, particularly those who desire a balance of automation and education without the burden of coding, Gomoon.ai offers a promising pathway to enhance their market understanding and decision-making processes. The platform's ability to help forecast stock market activity, avoid costly surprises, and provide a smart way to hedge against economic events in 2025 certainly makes a strong case for its utility.

However, as with any advanced tool in the YMYL domain, a pragmatic approach is essential. While Gomoon.ai is trusted by 6,000+ traders, and its terms and conditions emphasize transparency, it's crucial to remember that AI is a powerful assistant, not a crystal ball. The financial markets will always retain an element of unpredictability, and human judgment, risk management, and continuous learning remain paramount. If you're a trader looking to transform how you think about upcoming financial events, leverage AI to look for discrepancies between forecasts and actual outcomes, and gain a more intelligent perspective on market sentiment, then creating a new account with Gomoon.ai might be a valuable step. Explore its features, understand its strengths, and integrate its insights judiciously into your overall trading strategy. The future of trading is increasingly intelligent, and tools like Gomoon.ai are certainly at the forefront of this exciting evolution. What are your thoughts on AI's role in future trading? Share your insights in the comments below!