The question "Is the Airbnb dream dead?" echoes across the short-term rental landscape, a significant concern for both seasoned hosts and hopeful investors. From scenic Lake Tahoe properties, like the one seen in the Agate Bay community near Carnelian Bay, California, captured by Jessica Christian for The San Francisco Chronicle/Getty Images, to bustling urban centers, the once-unbridled growth of Airbnb seems to be facing unprecedented headwinds.

This comprehensive article, updated with the latest figures as of March 25, 2025, delves into the complex market conditions, host struggles, and evolving guest expectations that are shaping the future of this global hospitality giant. We aim to provide a detailed explanation of housing market conditions for anyone asking, "Is the Airbnb dream dead?"

Table of Contents

- The Shifting Sands of Airbnb: A Market Overview

- The Airbnb Host's Reality: Shrinking Margins and Oversupply

- The Guest Experience: Pricing Woes and Service Gaps

- Airbnb's Leadership Navigates Turbulent Waters

- The "Airbnb Arbitrage" Debate: A Double-Edged Sword

- The Pandemic's Lingering Shadow and Future Outlook

- Is the Airbnb Dream Dead? A Nuanced Perspective

The Shifting Sands of Airbnb: A Market Overview

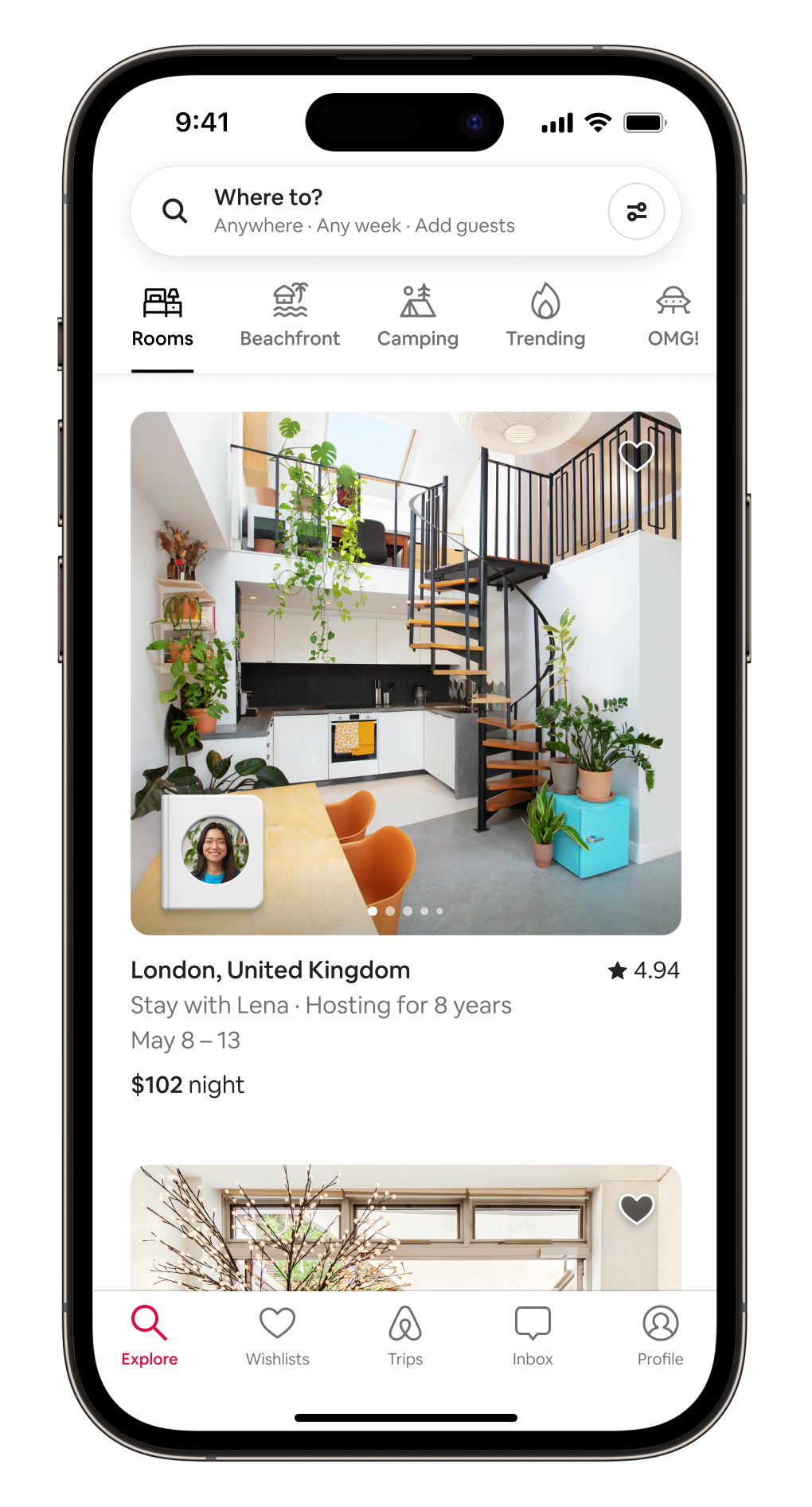

For years, Airbnb represented a revolutionary force in the travel and hospitality industry, offering unique stays and empowering individuals to monetize their spare rooms or second homes. The concept of "Airbnb arbitrage" became a common strategy, where individuals would rent apartments and then list them on Airbnb, often making thousands of dollars a month. This innovative approach allowed people to go to Airbnb and use somebody else's home, fostering a sense of community and providing diverse accommodation options. However, this also meant Airbnb came to compete directly with traditional hotels and long-term rental markets, fundamentally altering urban landscapes and housing dynamics.

As of March 25, 2025, the market is showing signs of saturation and shifting dynamics. We are observing a noticeable decline in utilization rates for Airbnb properties. Anecdotal evidence, such as seeing Airbnb advertising locally – something previously uncommon – suggests that the platform is actively working to attract more bookings in saturated areas. This increased marketing spend could indicate a need to fill available inventory, a stark contrast to the earlier days when demand often outstripped supply. The initial gold rush has certainly matured, leading many to ponder: is the Airbnb dream dead, or merely evolving?

The Airbnb Host's Reality: Shrinking Margins and Oversupply

The "Airbnbust" frenzy that swept through social media in March 2023 saw hosts taking to platforms like Twitter (now X) to voice their frustrations over shrinking profit margins and a perceived downturn in business. This sentiment wasn't unfounded. Airbnb hosts in popular vacation spots are indeed seeing fewer bookings and lower revenue. The primary culprit? An undeniable oversupply of properties. What was once a lucrative side hustle or a primary income stream for many has become a fiercely competitive arena.

Data from Airbnb itself confirms this trend, reporting that revenue per room has declined in several key locations. Iconic vacation destinations like Orlando and Joshua Tree, known for their theme parks and natural beauty respectively, have experienced significant drops. Similarly, Gatlinburg and Pigeon Forge, popular spots in the Great Smoky Mountains, have also been hit hard. This widespread decline in earnings for hosts highlights a critical challenge: the market has become flooded with options, making it harder for individual properties to stand out and secure consistent bookings.

Adapting to the New Normal: Host Strategies

In response to these challenging conditions, hosts are not simply throwing in the towel. They are adapting, evolving their strategies to stay competitive in a crowded market. This often involves a dual approach: improving amenities and cutting prices. To justify their rates and attract guests, hosts are investing in upgrades, from high-speed internet and smart home features to more luxurious bedding and unique decor. The goal is to create a more appealing and comfortable experience that stands out from the multitude of listings.

Simultaneously, many hosts are finding it necessary to reduce their prices. While this directly impacts their profit margins, it's a pragmatic move to ensure properties remain booked. This price adjustment, coupled with enhanced offerings, is a testament to the resilience and entrepreneurial spirit of the Airbnb host community, as they navigate a market that demands more value for less money.

The Guest Experience: Pricing Woes and Service Gaps

While hosts grapple with declining revenues, guests often face their own set of frustrations, particularly concerning pricing transparency and customer service. Airbnb's pricing has always been a curse and a blessing. On one hand, it offers a diverse range of unique accommodations often at competitive base rates. On the other hand, the final cost of a stay at a certain place can sometimes be difficult to comprehend. Cleaning fees, service fees, and taxes seemingly bog down the guests, often adding a significant percentage to the initial nightly rate. This lack of upfront clarity can lead to sticker shock and a feeling of being overcharged, eroding trust and satisfaction.

Beyond pricing, customer service remains a persistent pain point. A 2021 study, which analyzed more than 125,000 Airbnb complaints on Twitter, revealed alarming statistics: a staggering 72% of the issues were related to poor customer service, and 22% were related to scams. These figures underscore a fundamental challenge for Airbnb: maintaining high-quality support for its vast, global user base. When guests encounter problems, whether it's an unresponsive host, a misleading listing, or a technical glitch with the platform, the difficulty in resolving these issues quickly and satisfactorily can severely tarnish their experience and lead them to seek alternatives.

Airbnb's Leadership Navigates Turbulent Waters

Leading a company through such dynamic shifts requires strong, adaptive leadership. Brian Chesky, Airbnb's CEO, is no stranger to big lifts. He has guided the company through numerous challenges, including the existential threat posed by the COVID-19 pandemic. However, even for a seasoned leader like Chesky, 2023 was not an easy year. The "Airbnbust" frenzy in March, fueled by host complaints about shrinking profit margins, put immense pressure on the company's executive team. Chesky has had to address these concerns head-on, acknowledging the need for the platform to better support its hosts while continuing to attract guests.

His leadership in this period has involved a delicate balancing act: addressing host grievances, maintaining investor confidence, and ensuring the platform remains competitive against a backdrop of evolving travel trends and economic uncertainties. The success of Airbnb in the coming years will largely depend on Chesky's ability to innovate and steer the company through these turbulent waters, finding new ways to add value for both hosts and guests and restore faith in the platform's long-term viability.

The "Airbnb Arbitrage" Debate: A Double-Edged Sword

The rise of "Airbnb arbitrage" has been a contentious topic, highlighting a significant societal debate. While it allowed many to make thousands of dollars a month by renting apartments and re-listing them, it also brought Airbnb into direct competition with the traditional long-term rental market. This practice, alongside the general proliferation of short-term rentals, has been accused by some of contributing to housing shortages and rising rents in certain urban areas, as properties are converted from residential use to tourist accommodation.

It's crucial to differentiate between different types of hosts. People starting Airbnbs that make them a couple thousand extra dollars a month, perhaps to supplement their income, aren't typically seen as the problem. These are often lower-middle-class individuals looking for some extra income, trying to make ends meet. The real concern, according to critics, lies with the "20 people who have enough money to literally own 100 million Airbnbs who are sucking the life out of society." This refers to large-scale, corporate operators or wealthy individuals who amass vast portfolios of short-term rentals, potentially exacerbating housing affordability issues. For instance, a walkthrough of a property in Arizona by Pace Morby with Jack Selby from The Iced Coffee Hour showcased a property set to cash flow over a significant amount, illustrating the scale of some of these operations. Interestingly, before Airbnb, there were approximately 5 million second homes in the US. In the decade since Airbnb came online, we've actually seen a reduction in the total number of second homes, but a much higher percentage of those remaining second homes are now listed on Airbnb, indicating a shift in how these properties are utilized rather than a pure increase in their number.

The Role of Platform Greed

Adding to the complexities, some hosts feel that Airbnb itself is contributing to the problem through its fee structure. One host commented, "I suspect Airbnb is being too greedy now, charging the host and guest a good chunk for each stay compared to Booking.com, which recently seems to be the majority of my reservations nowadays." This sentiment suggests that the platform's commission rates, applied to both sides of the transaction, are making it less attractive for both hosts and guests compared to competitors. If hosts find they can secure more reservations and retain a larger share of their earnings through other platforms, and guests find more transparent pricing elsewhere, Airbnb's market dominance could be further challenged.

The Pandemic's Lingering Shadow and Future Outlook

The significant impact of the pandemic on Airbnb's business cannot be overstated. Travel restrictions and health concerns brought the industry to a near standstill, forcing the company to make difficult decisions, including layoffs. However, Airbnb demonstrated remarkable resilience, pivoting to cater to longer stays and domestic travel as people sought escapes closer to home. This adaptability allowed the company to weather the storm and emerge on the other side, albeit with a changed landscape.

Looking ahead to March 25, 2025, the company reports that demand is expected to increase by 10.7% due to ongoing economic growth and the continued recovery of domestic travel. This projection offers a glimmer of hope, suggesting that the underlying desire for unique travel experiences remains strong. Airbnb's vast global footprint, boasting 8 million vacation rentals, 2 million "Guest Favorites," and presence in over 220 countries and regions worldwide, positions it well to capitalize on this anticipated rebound. The platform's extensive network means there's an Airbnb for every kind of trip, from city breaks to remote getaways, catering to a diverse range of travelers.

My Seven Years in the Pacific Northwest

As someone who has run a short-term rental in the Pacific Northwest for seven years now, I've witnessed these shifts firsthand. The initial years were marked by consistent bookings and strong revenue. More recently, however, the market has undeniably tightened. I've had to become more proactive in my pricing strategies, invest more in property maintenance and upgrades, and pay closer attention to guest reviews to maintain my listing's appeal. The competition is palpable, and what once felt like effortless income now requires more strategic management and a keen eye on market trends. This personal experience aligns with the broader data indicating a more challenging, but not impossible, environment for hosts.

Is the Airbnb Dream Dead? A Nuanced Perspective

So, is the Airbnb dream dead? The answer, as with most complex market questions, is nuanced. It's certainly not the unbridled gold rush it once was. The era of easy profits and minimal effort for hosts has largely passed, replaced by a more competitive, mature market demanding professionalism, strategic pricing, and exceptional guest experiences. The challenges are real: oversupply in popular areas, declining revenue per room, persistent customer service issues, and the ongoing debate around pricing transparency and platform fees.

However, declaring Airbnb dead would be premature. The platform continues to be a dominant force in global travel, with millions of listings and a projected increase in demand. It has fundamentally changed how people travel and how property owners utilize their assets. The "dream" isn't dead, but it has evolved. For hosts, it means adapting, innovating, and treating their listings as a serious business. For guests, it means being more discerning, understanding the full cost upfront, and valuing quality experiences. Airbnb, under Brian Chesky's leadership, faces the challenge of re-calibrating its value proposition for both sides of its marketplace to ensure its long-term vitality.

Conclusion

The narrative surrounding Airbnb has undeniably shifted from boundless opportunity to one of significant challenges and necessary adaptation. As of March 25, 2025, the data paints a clear picture: the market is more competitive, hosts are feeling the squeeze, and guests are demanding better value and service. While the initial "Airbnb dream" of effortless income may have faded for many, the platform itself is far from defunct. It's undergoing a crucial period of maturation, forcing both the company and its users to evolve.

For those considering entering the short-term rental market, or existing hosts looking to thrive, understanding these dynamics is paramount. Success now hinges on strategic thinking, investment in quality, and a deep understanding of market conditions. What are your thoughts on the future of Airbnb? Have you experienced these shifts as a host or a guest? Share your insights in the comments below, and don't forget to explore our other articles on navigating the evolving travel and real estate landscape.